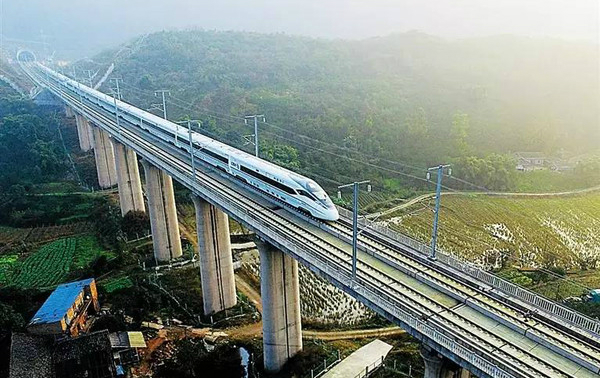

Rail Technology: The Amazing Catch Up that Propelled the Chinese Economy

The successive wins of rail contracts in HSR and urban rolling stock in the US attest to the price competitiveness and technological sophistication of indigenous Chinese rail technology.