By Henry Hing Lee Chan

China’s Economy: Signs of Weaning Away from Old Model?

Despite the stability of the Chinese financial market and exchange rate since March 2016, the trajectory of the Chinese economy in the coming months will remain a keenly watched issue. Believers on the Chinese economy like Ma Yun hold the belief that China is facing a short-term 3 to 5 years problem and it will resume speedier growth afterwards. Others like Soros compare the Chinese economy to that of US before 2008 and see it as being in imminent danger. Only time will tell which of the two is correct in its prognosis, or if they are both wrong.

It seems the basis of Ma Yun’s trust in China is based on the potential of the real economy of China to restructure itself and resume growth, while Soros’ pessimism is based on the overleverage problem on the monetary side of the economy. The interaction of both economies has remained a challenge to economists ever since the time of Keynes and Schumpeter. They both witnessed the Wall Street crash of 1929 and saw first hand how the financial economy wrecked the real economy into a depression. The Great Depression demonstrated the unequivocal destrutive power of the financial economy on the real economy when they are not properly in sync. We are in no position to pass judgement on the symbiotic relations between the two economies. However, there are doubts about the restructuring efforts of China and we note two interesting items of information that could shed some light on the issue.

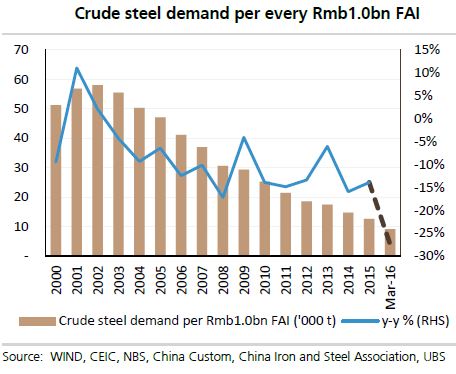

The first is a report from Yang Luo, a UBS analyst, on China’s steel industry. He notes that the crude steel demand on every RMB 1 billion in fixed-asset investment (FAI) has plunged 27.4 percent to 9.2 kilotons (kt) in March 2016 from 12.7 kt in 2015 (see figure on crude steel demand). The recent emphasis of government stimulus on “effective investment” that steers FAI away from simple brick and mortar has apparently contributed to the sharp fall. When the steel intensity of 2015 is compared to the 47 kt of 2005, there is a negative compound annual growth rate of 12.3 percent over 2005-2015. This downward shift of steel intensity in the FAI points to a modern and balanced FAI portfolio as the experience of advanced countries shows. Investing in building requires a lot of steel while investing in high-speed rail will use much less steel. This anecdotal evidence seems to indicate that China is indeed moving towards a more modern FAI cycle and is cutting down on wasteful infrastructure than is commonly thought.

The second is the recently-released first-quarter 2016 national tax collection figures. The government collected RMB 2.98 trillion, an increase of 9.8 percent over the corresponding period last year. Removing unusual items like additional oil tax from the collapse in oil prices, the net increase of 5.3 percent is still impressive under the current 6.7 percent GDP growth scenario. One recalls that the finance minister did not sound confident as late as February on tax collection growth this year.

What is more surprising were the sources of the tax revenue growth. Tertiary sector revenue grew 12 percent and accounts for 56.5 percent of total revenue. Growth in modern service tax collection is particularly impressive: business service related tax grew 30.3 percent, internet service tax grew 29.9 percent, information and communication technologies sector tax intake grew 32.2 percent, and media sector tax revenue grew 30.4 percent. In the industrial sector, electronics and communication sector tax grew 8.3 percent, medical sector tax grew 11.6 percent and aerospace sector tax grew 11.9 percent. The tax revenue spokesman proudly announced the tax collection result proved the initial success of the current economic restructuring effort of the government.

Whether the tax department spokesman is too optimistic or a trend is indeed being formed is not an easy question to answer. However, the two pieces of information seem to indicate some success in the economic transformation of China. The declining steel intensity and increasing tax intake from the modern manufacturing and service sectors bode well for the real economy. Let us hope the real economy will pull China out of the overleveraging problem and its goals of removing leverage, removing excess capacity, and removing excess properties can be slowly achieved under a dynamic real economy.

Leave a Reply

Your email address will not be published. Required fields are marked *